By: Charles W. Kettenacker

As you probably know, a PAC doesn’t have a beneficial owner, but they do typically use business/commercial checking accounts to deposit funds and issue checks. If a PAC creates a new account, or makes changes to an existing account you will most likely run into a situation where you’ll be asked to complete a Beneficial Ownership Form. The new Beneficial Ownership rule is simply a form to document ownership, or state that there isn’t ownership.

On May 11, 2018, the Financial Crimes Enforcement Network (FinCEN), under the Bank Secrecy Act, enforced a new Beneficial Ownership rule 31 CFR 1010.230, that all financial institutions will be required to ask for additional information when new commercial deposit/loan accounts are opened, or existing ones are changed. This rule is intended to assist the government and law enforcement in combating money laundering, tax evasion, and the financing of terrorism.

This new rule affects all business/commercial accounts, regardless of the type of entity, when a new account is opened, or when changes are made to an account, such as changing account signers. Most banks will have a separate form that will need to be signed by a “Control Person”. This individual is certifying that the information provided to the financial institution about the entity is up to date, and correct to the best of their knowledge.

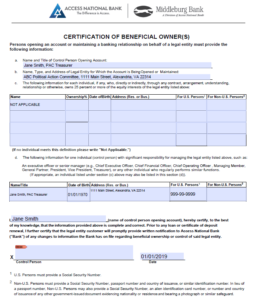

There are typically two parts to the form, Ownership and Control.

- Ownership — Any individual who directly or indirectly owns 25% or more of the equity interests in the legal entity. Up to four individuals may be identified. In some cases, there may not be an individual identified under ownership, i.e., if no individual owns 25% or more, or if it’s an entity that does not have a designated owner. Exemptions for ownership apply to Sole Proprietors, Non-profits, Political Action Committees (PACs) and Unincorporated Associations. Some banks may require ownership documentation for individuals with 10% or more, however the rule specifies 25% or more.

- Control — The control factor requires one (1) identified individual (usually an account signer) with significant managerial control over the legal entity, e.g., an Executive Officer, Senior Manager, or any other individual who regularly performs similar functions. An individual identified under ownership can also be identified as the control person. Every entity or organization (no exemptions) will have some type of Control Person in place. Again, this Control Person is certifying that the ownership information provided on the form is accurate and up to date. For PACs, this would presumably be the PAC Treasurer.

In addition to the completed form, any beneficial owner and the control person will need to provide a copy of one form of identification, such as a driver’s license or passport. The identified control person of each covered entity is required to complete a certification form (mentioned above), and provide personal identification information, i.e., date of birth, social security number, and a residential or business address. This information may be repetitive since banks require this information for signers anyway.

Once this form is completed, future changes to an account may require a re-certification. The re-certification may be verbal or by email, and documented by your banker; no new form is required.

Example of a completed form:

Charles W. Kettenacker,

VP- PAC, Campaign & Nonprofit Banking

Access National Bank

For additional inquiries, please contact Mr. Kettenacker here.